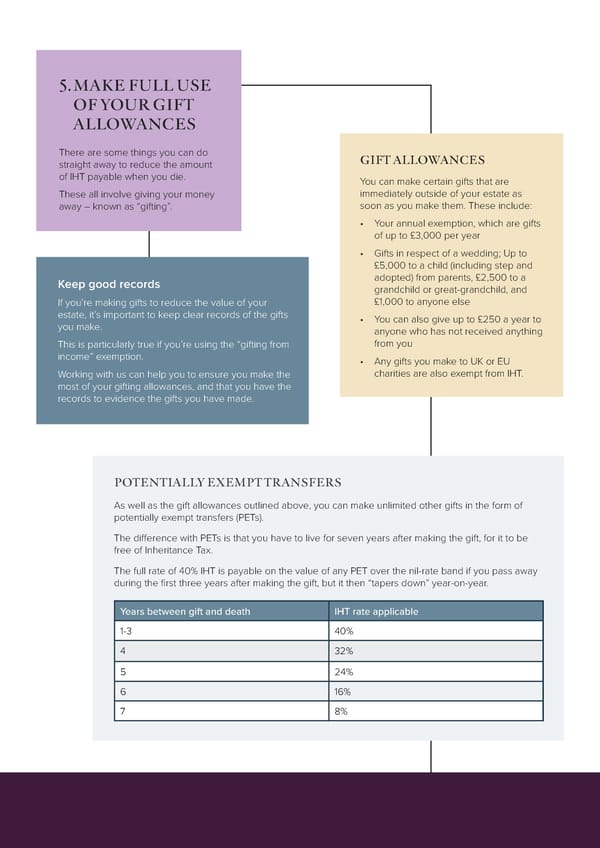

5. MAKE FULL USE OF YOUR GIFT ALLOWANCES There are some things you can do GIFT ALLOWANCES straight away to reduce the amount of IHT payable when you die. You can make certain gifts that are These all involve giving your money immediately outside of your estate as away – known as “gifting”. soon as you make them. These include: • Your annual exemption, which are gifts of up to £3,000 per year • Gifts in respect of a wedding; Up to £5,000 to a child (including step and Keep good records adopted) from parents, £2,500 to a grandchild or great-grandchild, and If you’re making gifts to reduce the value of your £1,000 to anyone else estate, it’s important to keep clear records of the gifts • You can also give up to £250 a year to you make. anyone who has not received anything This is particularly true if you’re using the “gifting from from you income” exemption. • Any gifts you make to UK or EU Working with us can help you to ensure you make the charities are also exempt from IHT. most of your gifting allowances, and that you have the records to evidence the gifts you have made. POTENTIALLY EXEMPT TRANSFERS As well as the gift allowances outlined above, you can make unlimited other gifts in the form of potentially exempt transfers (PETs). The difference with PETs is that you have to live for seven years after making the gift, for it to be free of Inheritance Tax. The full rate of 40% IHT is payable on the value of any PET over the nil-rate band if you pass away during the first three years after making the gift, but it then “tapers down” year-on-year. Years between gift and death IHT rate applicable 1-3 40% 4 32% 5 24% 6 16% 7 8%

8 Practical Ways to Ensure Your Family Get More of Your Wealth Than the Taxman Page 9 Page 11

8 Practical Ways to Ensure Your Family Get More of Your Wealth Than the Taxman Page 9 Page 11