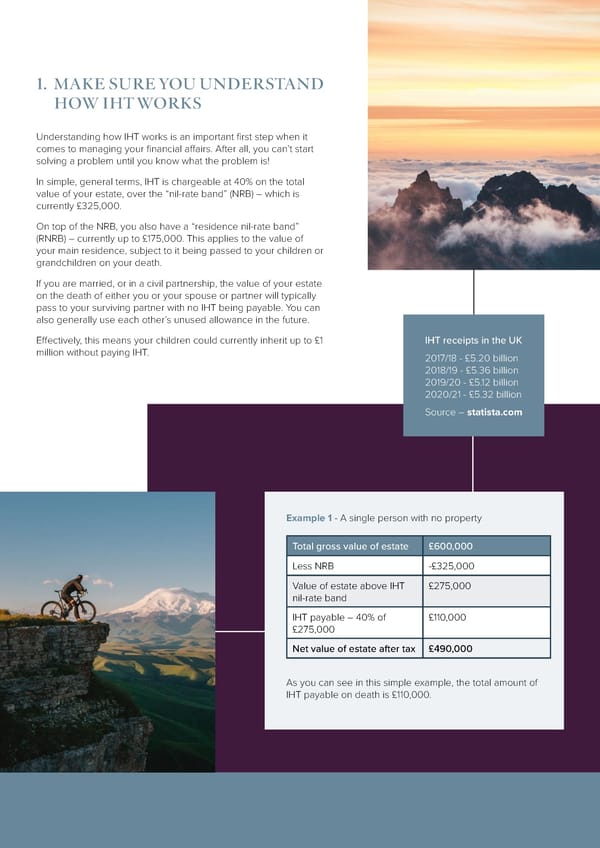

1. MAKE SURE YOU UNDERSTAND HOW IHT WORKS Understanding how IHT works is an important first step when it comes to managing your financial affairs. After all, you can’t start solving a problem until you know what the problem is! In simple, general terms, IHT is chargeable at 40% on the total value of your estate, over the “nil-rate band” (NRB) – which is currently £325,000. On top of the NRB, you also have a “residence nil-rate band” (RNRB) – currently up to £175,000. This applies to the value of your main residence, subject to it being passed to your children or grandchildren on your death. If you are married, or in a civil partnership, the value of your estate on the death of either you or your spouse or partner will typically pass to your surviving partner with no IHT being payable. You can also generally use each other’s unused allowance in the future. Effectively, this means your children could currently inherit up to £1 IHT receipts in the UK million without paying IHT. 2017/18 - £5.20 billion 2018/19 - £5.36 billion 2019/20 - £5.12 billion 2020/21 - £5.32 billion Source – statista.com Example 1 - A single person with no property Total gross value of estate £600,000 Less NRB -£325,000 Value of estate above IHT £275,000 nil-rate band IHT payable – 40% of £110,000 £275,000 Net value of estate after tax £490,000 As you can see in this simple example, the total amount of IHT payable on death is £110,000.

8 Practical Ways to Ensure Your Family Get More of Your Wealth Than the Taxman Page 3 Page 5

8 Practical Ways to Ensure Your Family Get More of Your Wealth Than the Taxman Page 3 Page 5